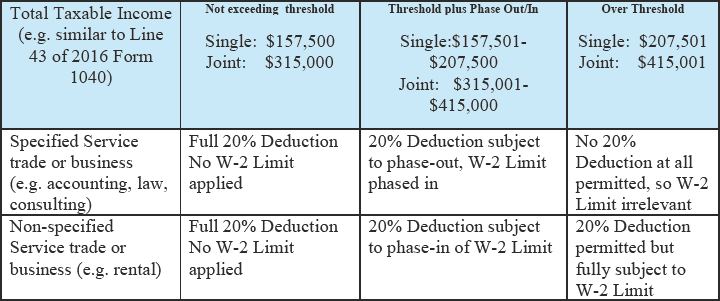

I have been reviewing 2016 income tax returns with my clients, who own various types of businesses and assets. This helps them when they meet with their accountants and CPAs for their 2017 income tax returns, to begin planning under the Tax Cuts and Jobs Act (“Act”). The key item that I look at is their taxable income in order to determine the threshold limitation in the chart below and what can be done when they are either under or over the threshold amount.

This article will focus on four examples of the wage threshold planning for a non-specified business, and, where there is no opportunity to overcome the threshold planning. If that is the case, see Example 5 for either gifting or selling assets in a complex trust to children and grandchildren. If in Example 3, the business is a specific service business and there would be no deduction as shown in the below chart because of being over the threshold amount.

Pass-Through Businesses. One of the Act’s most sweeping changes is the reform of the tax regime that applies to pass-through businesses—sole proprietorships, partnerships, S corporations, and limited liability companies taxed as partnerships or S corporations. Owners of pass-through businesses currently pay tax at their individual tax rates, which could reach as high as 37% under the Act. Starting January 1, 2018, income tax on most pass-through businesses have a 20% deduction that has a tax rate of 29.6%. (20% x 37%). A C Corporation tax rate is now 21% which is permanent compared to the individual rates that are scheduled to end on December 31, 2025.

How to Determine the 20% Pass-Through Benefit? In a recent article written by Alan Gassman and Brandon Ketron they discussed a 4-step process to determine what will be the 20% Pass-Through business benefit. They are as follows:

- Identify the 20% pass-through business and its income.

- Apply the income limits at the individual level based upon the activity involved.

- Identify activities that cannot qualify if the individual 2018 income exceeds $415,000 (married) – $207,500 (single), 0R where the deduction is reduced if the 2018 income exceeds $315,00- (married) – $157,500 (single).

- Navigate the wages and qualified property test where the taxable income is above $315,00- (married) – $157,500 (single) that is reduced by the greater of (a) the salaries paid by the activity or (b) the sum of a portion of salaries paid plus a percentage of the value of qualified property used in the activity.

Below is a chart that will be helpful to understand some of the complex concepts discussed above.

Example 1 – Below Taxable Income Threshold – Wage Limitation Does Not Apply

T operates a business that generates $25,000 of QBI during the year and T pays $8,000 of W-2 wages during the year. T files a joint return with taxable income of $300,000. T’s Section 199A deduction is $5,000 ($25,000 x 20%). Because T’s taxable income is less than the $315,000 threshold amount, the W-2 wage limitation does not apply to limit T’s Section 199A deduction.

Example 2 – Above Taxable Income Threshold – Wage Limitation Phases In

Assume the same facts as Example 1, except that T’s taxable income for the year is $355,000. The W-2 wage limitation is phased in because T’s taxable income is between $315,000 and $415,000. The phase-in percentage is equal to 40% (($355,000 – $315,000)/$100,000). The amount of the Section 199A deduction is disallowed by the phased in limitation is $400 (($5,000 – $4,000) x 40%). Thus, T’s Section 199A deduction is limited to $4,600 ($5,000 – $400).

Example 3 – Above Taxable Income Threshold – Wage Limitation Fully Applies

Assume the same facts as Example 1, except that T’s taxable income for the year is $420,000. The W-2 wage limitation fully applies to limit T’s Section 199A deduction because T’s taxable income exceeds $415,000 ($315,000 threshold amount plus $100,000). The W-2 wage limitation is $4,000 ($8,000 W-2 wages x 50%). Thus, T’s Section 199A deduction is limited to $4,000.

Example 4 – Above Taxable Income Threshold – Form New Pass-Through Entity and Pay Wages

T engages in a non-specified business earns $1,000,000, after all expenses, and operates as a sole proprietorship or disregarded entity LLC with no employees and no depreciable assets. In that type of structure, the taxpayer would have “0” Section 199A deduction because of the Form W-2 Limit applicable to high income taxpayers. If the trade or business is formed as an S-Corporation and wages are paid to the taxpayer, a Section 199A deduction may be had. However, as the wage is paid to the taxpayer, the amount of Qualified Business Income is reduced. The algebraic formula for obtaining the maximum deduction in this example is 20% (Y-X) = 50% X, with Y as the income prior to payment of wages and X the wages. The result is .2857 of income should be paid as wages to maximize the deduction, which in this example would be $285,7000 of wages and Section 199A deduction of $142,857.14.

Example 5 – Gifting or Selling Part of a Pass-Through Entity to a Complex Trust for Children and Grandchildren.

If a taxpayer’s taxable income exceeds the threshold amount, a portion of the income could be shifted to a separate taxpayer by using a complex trust.

For example, John, a married individual, receives $300,000 of flow through income from his wholly owned LLC that is a specified service trade or business. John also receives a salary of $125,000, therefore John’s taxable income ($425,000) exceeds the threshold limitation and he is not eligible for the Section 199A deduction.

John could gift or sell 50% of the LLC to a complex trust for his wife and/or children. John would still receive his $125,000 salary, but now John’s flow through income would only be $150,000. The remaining $150,000 of flow through income would be allocated to the complex trust assuming that the income was not distributed out to the beneficiaries. As a result, John now has taxable income of $275,000 ($125,000 salary + $150,000 flow through income) and can take a Section 199A deduction of $30,000.

Although the trust’s income will be taxed at the highest bracket due to the compressed rate tables, it can also take a $30,000 Section 199A deduction on its $150,000 of flow through income. This results in the income being taxed at an effective tax rate of 29.6%, which is less than the 35% tax bracket John was in prior to the transfer of the LLC to the complex trust.

If the income is distributed to the beneficiaries of the trust, the income will be taxed at their individual tax brackets and they will also have the ability to take a Section 199A deduction. If John’s wife is also a beneficiary of the trust distributions should be limited so that John and his wife’s taxable income will not exceed the income limitation amount.

Gifts or sales may be to children, complex trusts, electing small business trusts, qualified subchapter S trusts, charities, charitable remainder trusts and other entities. Future writings of the authors will provide details on the advantages and disadvantages of gifting or selling ownership interests to one or more of the above specified entities.

A complex trust can also direct income to charities to have the equivalent of a charitable deduction under Section 642(c) without the itemized deduction and percentage of Adjusted Gross Income limitations applying.