Because of the complexities of the Tax Cuts and Jobs Act (“Act”) that is effective January 1, 2018 many taxpayers will not be able to take the 20% pass-through business deduction in 2018 due to improper positioning, or failure to restructure in ways that can make the deduction available. One of the main reasons deals with the difference between specific service business and non- specific service business discussed below. Another major factor is that there are certain limitations on deductions such as wages and 2.5% cost on all qualified property test. Please see chart and example at the end of this article.

Pass-Through Businesses. One of the Act’s most sweeping changes is the reform of the tax regime that applies to pass-through businesses—sole proprietorships, partnerships, S corporations, and limited liability companies taxed as partnerships or S corporations. Owners of pass-through businesses currently pay tax at their individual tax rates, which could reach as high as 37% under the Act. Starting January 1, 2018, income tax on most pass-through businesses have a 20% deduction that has a tax rate of 29.6%. (20% x 37%). A C Corporation tax rate is now 21% which is permanent compared to the individual rates that are scheduled to end on December 31, 2025.

Deduction for Qualified Business Income. The deduction applies at the owner level and also applies to 20% of qualified real estate investment trust (REIT) dividends, qualified cooperative dividends, and qualified publicly traded partnership income and is available for trusts and estates that own pass-through businesses. The deduction applies to qualified business income (QBI), which is defined as the net amount of qualified items of income, gain, deduction, and loss with respect to a qualified trade or business of the taxpayer.

The deduction applies to qualified business income (QBI), which is defined as the net amount of qualified items of income, gain, deduction, and loss with respect to a qualified trade or business of the taxpayer. “Qualified items of income, gain, deduction, and loss” includes business income other than investment income. QBI does not include wages, dividends, investment interest income, capital gains (whether short-term or long-term), commodities gains, or foreign currency gains.

“Qualified Trade or Business” Limitation. Only a qualified trade or business may qualify for the deduction. While the definition of qualified trade or business is broad, it excludes some activities. Notably, it excludes a category of businesses called specified service businesses.

The definition of specified service business includes:

- any trade or business involving the performance of services in the fields of health, law, consulting, athletics, financial services, and brokerage services;

- any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees or owners; and

- any trade or business which involves the performance of services that consist of investing and investment management, trading, or dealing in securities, partnership interests, or commodities.

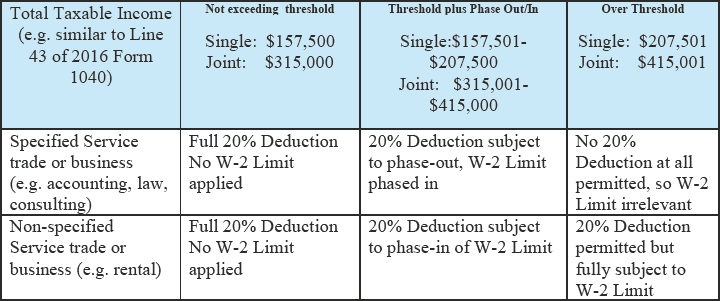

Exclusion and Exception. Although the general definition of specified service business excludes many small businesses from being qualified trades or businesses, the Act provides an important exception: Joint filers with income below $315,000 and other taxpayers with income below $157,500 can claim the deduction fully on income from specified service businesses. This exception is phased out for taxpayers that exceed the threshold. The phase out occurs over the next $100,000 for joint filers and $50,000 for other taxpayers. No deduction is available to owners of services businesses if their income exceeds $415,000 for joint filers or $207,500 for other taxpayers. For purposes of this threshold, taxable income is determined without regard to the deduction. The threshold is also inflation adjusted under the Act.

The definition of qualified trade or business also excludes the trade or business of performing services as an employee. Amounts paid to an owner-employee—for example, an S corporation shareholder that is also an employee—as reasonable compensation are not included in QBI. Similarly, if a partnership makes a guaranteed payment under Internal Revenue Code (Code) § 707(c) or a payment for services under Code § 707(a), those payments are not included in QBI.

How to Determine the 20% Pass-Through Benefit? In a recent article written by Alan Gassman and Brandon Ketron they discussed a 4-step process to determine what will be the 20% Pass-Through business benefit. They are as follows:

- Identify the 20% pass-through business and its income.

- Apply the income limits at the individual level based upon the activity involved.

- Identify activities that cannot qualify if the individual 2018 income exceeds $415,000 (married) – $207,500 (single), 0R where the deduction is reduced if the 2018 income exceeds $315,00- (married) – $157,500 (single).

- Navigate the wages and qualified property test where the taxable income is above $315,00- (married) – $157,500 (single) that is reduced by the greater of (a) the salaries paid by the activity or (b) the sum of a portion of salaries paid plus a percentage of the value of qualified property used in the activity.

Some Planning Considerations: Some planning considerations based upon the above 4-step analysis are as follows:

- Increase Pension Contributions to Reduce Taxable Income.

- Move Income into a C Corporation or pay deductible expense to other entities.

- Buy a New Piece of Equipment to Generate a Section 179 Deduction.

- Consider Gifting or Selling Part of a Pass-Through Business to a Complex Trust for Children and Grandchildren.

- Separate specific service business from non- specific service business.

Below is a chart that will be helpful to understand some of the complex concepts discussed above.

Wage Example. A taxpayer engages in a non-specified business earns $1,000,000, after all expenses, and operates as a sole proprietorship or disregarded entity LLC with no employees and no depreciable assets. In that type of structure, the taxpayer would have “0” Section 199A deduction because of the Form W-2 Limit applicable to high income taxpayers. If the trade or business is formed as an S-Corporation and wages are paid to the taxpayer, a Section 199A deduction may be had. However, as the wage is paid to the taxpayer, the amount of Qualified Business Income is reduced. The algebraic formula for obtaining the maximum deduction in this example is 20% (Y-X) = 50% X, with Y as the income prior to payment of wages and X the wages. The result is .2857 of income should be paid as wages to maximize the deduction, which in this example would be $28,570 of wages and Section 199A deduction of $142,857.14.